For as long as we can remember, the high performance computing business was one where it has been difficult for the manufacturers that build systems to make a buck.

With the advent of GenAI and booming sales of AI servers to run training and often inference workloads, none of this has changed. And yet, someone has to build high performance computing systems and hope they can profit by trickling down technologies in smaller sizes to enterprises that will pay a premium for what hyperscalers, cloud builders, and government agencies get at cost or lower.

In the past, the makers of compute engines and interconnects were able to get profits from HPC, but the OEMs like Cray, Silicon Graphics, IBM, Bull, Fujitsu, Sun Microsystems, Convex, and a few others had trouble profiting from the systems they built using these components. The same held true of pure-play OEMs like Hewlett Packard Enterprise (before it bought Convex, Compaq, Digital Equipment, Tandem, SGI, and Cray) and Dell (before it bought EMC). If these companies were lucky, they broke even over the course of three year product cycle and received government funding for research and development expended to create the HPC products and maybe they sold a few large enterprises smaller versions of their clusters at a higher margin to sweeten it a little.

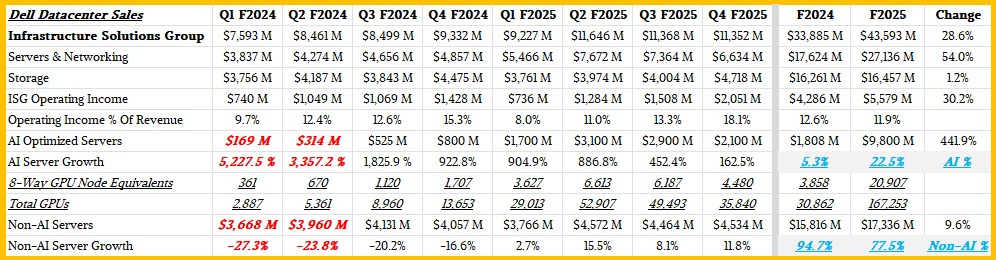

As far as we can tell, the situation is no different with AI servers. All of the OEMs are touting their AI server orders, revenues, and backlogs, and plotting out for us their curves as these grow, which is fascinating and informative to watch. But, as Dell explained once again when going over its financial results for its fourth quarter of fiscal 2025 that ended in January. AI server deals are driving revenues and are accretive to operating income, meaning they provide some incremental profitability, but they are also dilutive to operating income, meaning that the margins are much smaller than the rates that these companies enjoy selling general purpose servers and storage to enterprises at large.

Almost all of the margin of building AI systems is going to Nvidia for GPUs, interconnects, and sometimes CPUs as well as to those making memory and flash storage for these AI systems. AMD is getting some margins, and eventually Arista Networks and Cisco Systems will get their shares of the AI revenue and profit pie, too, but it hasn’t really happened yet. AMD is getting a skinny slice of GPU and CPU revenue from AI servers, and Intel has an even tinier slice of CPU revenue and profit. That’s about it.

The only thing worse than doing this complex AI server business, it seems, is not doing it. And Nvidia and AMD are too smart to want to be in the server manufacturing business.

Because of the complexity of building these systems and the relatively low markup that Dell and its peers can put on top of Nvidia GPUs, memory, and flash storage, profits are razor thin. Moreover, on the biggest deals, customers like xAI are bringing their own GPU allocations to the OEM or ODM manufacturer they choose, so if Dell doesn’t take the deal, then someone else gets bragging rights, which certainly do have a public relations and marketing value to Dell just like the sale of every HPC system in history has had within its community, state, and country.

AI servers have gross margins on the order of 5 percent. A mix of enterprise servers consisting of big systems for running ERP systems and databases, midrange machines for mid-sized companies, and less capacious boxes for small businesses have gross margins that are on the order of three times higher than this. The networking and storage attached to these systems adds more margin, and so does installation, tech support, and financing services. The latter is where companies like Dell, HPE, and Lenovo make up for the fact that building the physical server is not worth much margin at all.

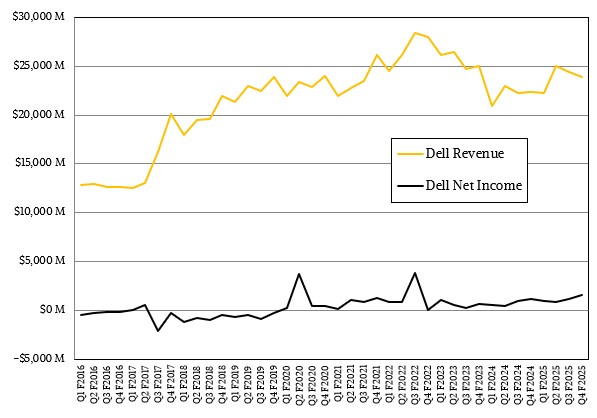

At the midpoint of the forecast that Dell gave three months ago, we all expected for Dell to rake in about $97 billion of revenues in fiscal 2025, but its sales were only up 8.1 percent to $95.57 billion. Part of this shortfall is that AI server revenues were not as high as expected, and the PC recovery was a little bit weaker, too.

Unless something weird happens in the global economy this year – well, something even weirder – Dell is going to break back through $100 billion in revenues this fiscal 2026 year, a feat it accomplished in its fiscal 2022 and 2023 years before it sold off a bunch of services businesses and shrank. To be precise, Dell is projecting fiscal 2026 revenues of $101 billion to $105 billion, up 8 percent at the midpoint to $103 billion.

By our reading of history and keeping track of the math, there have only been four companies that have broken through $100 billion in sales in the IT sector: IBM, HPE, Dell, and now Nvidia. Dell will rejoin the club, and this time, we think it will stay there. It remains to be seen if IBM and HPE will ever reach that level again.

IBM broke $100 billion in annual sales between 2008 and 2012, with a few years that were close before and after that, but has sold off many services businesses that ate into profits and shrank down to $60 billion; it has creepingly grown back to $62.75 billion in 2024, and at current anemic growth rates, it will take until 2057 for IBM to break through $100 billion again. (Buying HashiCorp and now Datastax will not move that needle much.)

The original Hewlett Packard conglomerate did it in the late 2000s and early 2010s before the company split off PCs and printers into HP Inc and sold off a bunch of IBM wannabe consulting businesses. HPE is growing more than twice as fast as IBM in its most recent year – in no small part because it is eating the bear meat of selling AI servers just like Supermicro, Dell, and Lenovo are doing – so it can break through $100 billion in sales by 2059 at current revenue growth rates.

As we reported earlier this week, Nvidia had $115.2 billion in datacenter revenues in its fiscal 2025 ended in January, up by a factor of 2.4X, and our model shows Nvidia hitting $183.6 billion in fiscal 2026 and $260.1 billion in fiscal 2027 – and that assumes a certain amount of price competition, AI model enhancements, and a slowing in both year on year and sequential growth rates for the Nvidia datacenter business. Nvidia’s gross margins in the datacenter are in the low 70 percents and are trending up to the middle 70 percents, by comparison. Being Michael Dell is pretty good, but being Jensen Huang is, at least for the moment, better. Much better.

With that context, let’s drill down into the Dell numbers for the latest quarter.

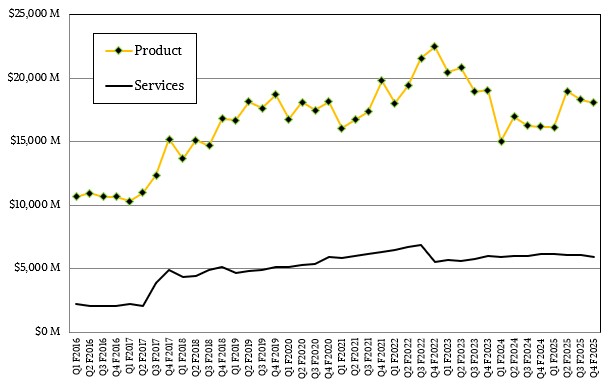

In the January quarter, Dell’s product sales were up 11.8 percent to $18.05 billion, and services sales fell by 4.7 percent to $5.88 billion. Both were down sequentially. The shrinking in services is a bit surprising.

Revenue for the quarter added up top $23.93 billion, up 7.2 percent. Operating income rose by 39.6 percent to $2.16 billion – Dell can pinch a penny so hard that Lincoln yelps, and is a genius at supply chain and direct customer sales – but net oncome only rose by 32.3 percent to $1.53 billion. That is 6.4 percent of revenue, which is the highest level of profitability that Dell has seen in a long while. And remember – AI is diluting this.

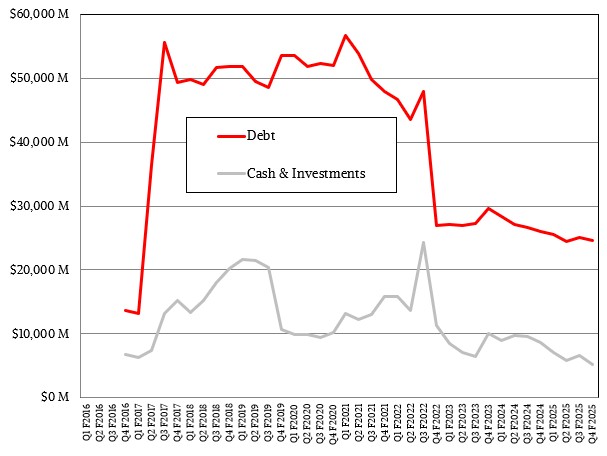

Dell ended the quarter with $5.13 billion in cash, which is not very much to be honest, and has $24.57 billion in debt, which is why. Those acquisitions of EMC and VMware were expensive, and the VMware float to Wall Street only cut the debts in half rather than paying them off.

In its Infrastructure Solutions Group, which sells servers, storage, and switching for datacenters, things are humming along even with the heavy diet of bear meat. Dell is supplementing its diet by squeezing extra fat out of its storage and traditional server businesses so it doesn’t suffer from financial malnutrition.

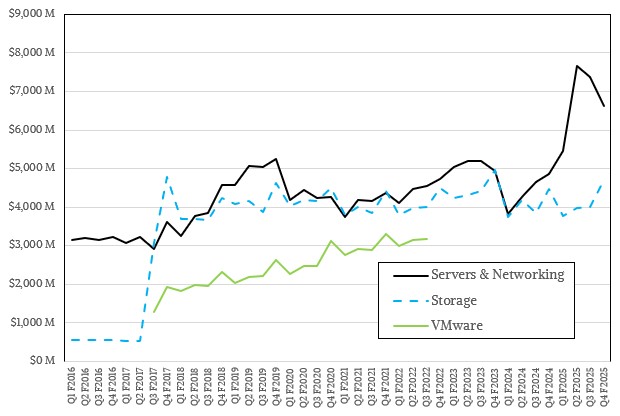

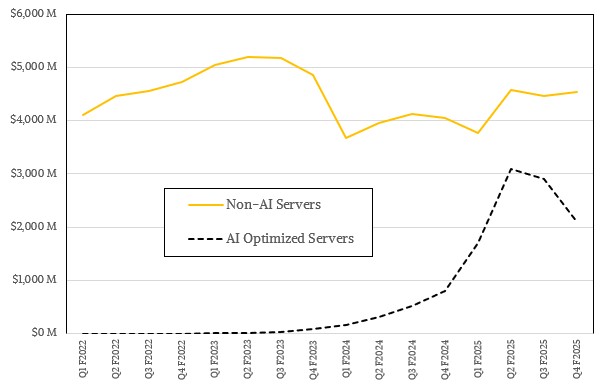

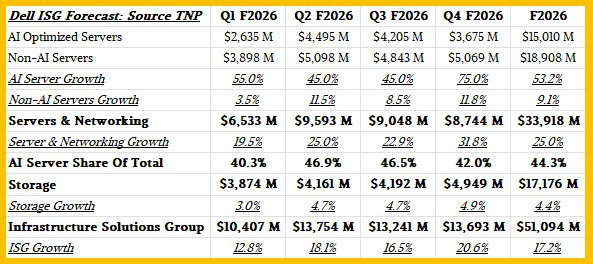

In Q4 F2025, ISG accounted for $11.35 billion in sales, up 21.6 percent. Within this, servers and networking revenues were $6.63 billion, up 36.6 percent. AI servers drove $2.1 billion in revenues, which were up by a factor of 2.62X but which were off 27.6 percent sequentially from the $2.9 billion in Q3. Remember that in Q2, Dell sold $3.1 billion in AI machinery. So by comparison, $2.1 billion was kind of weak and we think Dell was looking for more like $10.5 billion in sales and only hit $9.8 billion for the year due to weaknesses or timing issues with fiscal Q4. (Welcome to the HPC business. Again.)

Non-AI servers – meaning those running web infrastructure, databases, and back office applications – accounted for $4.53 billion in sales, up 11.8 percent and making the fourth quarter in a row of traditional server revenue growth and marking the end of the server recession for sure at Dell. The company almost filled in the AI server gap with aggressive sales of traditional PowerEdge servers, which might mean Q1 2026 is more difficult. Or, if demand is really high as companies look to refresh their ancient servers, maybe not. We will know in thirteen weeks.

Datacenter storage drove $4.72 billion in sales, up a mere 5.4 percent, but as we pointed out above, margins on storage were high enough to help offset the relatively poor margins on AI servers. Dell is selling more of its own storage, and more software-defined storage at that, which has higher margins and which also drives PowerEdge server sales, too.

Add it all up, and ISG had an operating income of $2.05 billion, up 43.6 percent and representing 18.1 percent of revenue. This is the highest operating income we have seen in eight years (our data doesn’t go back further for ISG because it didn’t exist before fiscal 2016).

Here is a table that brings the quarterly and annual financials together for Dell:

You can see above how the AI servers as a share of total servers has jumped, and it is going to go even higher in 2026. AI machines only comprised 5.3 percent of Dell servers and networking revenues in fiscal 2024, and it rose to 22.5 percent in fiscal 2025. It will not go above half in fiscal 2025, based on our model, but it is going to come close:

Just for fun in the big financial table, and to give a sense of the scale of the machinery to drive the AI server revenues, we estimated the total eight-way GPU node equivalents and the total number of GPUs shipped to drive the AI server revenues that Dell booked. This is admittedly a guess, but we don’t think it is a bad one.

Dell said in the call with Wall Street analysts that it would bring in at least $15 billion in revenues for AI servers in fiscal 2026, which would be a 53.2 percent increase over the $9.8 billion it booked in fiscal 2026. Traditional servers look like they will do well, and storage will get along at a lower growth rate but at a relatively high profitability.

Dell’s AI backlog stood at $4.1 billion as the January quarter ended, but in February Dell also booked a $4.9 billion deal with xAI for AI server infrastructure and that immediately made its backlog $9 billion.

That’s 60 percent down and only 40 percent left to sell to make that $15 billion in AI server sales expected this fiscal year. The wonder is why the backlog is not already larger, really, if enterprises are looking to add GenAI workloads and Dell is the largest OEM server maker in the world and one that makes one out of three servers in the enterprise.

Be the first to comment